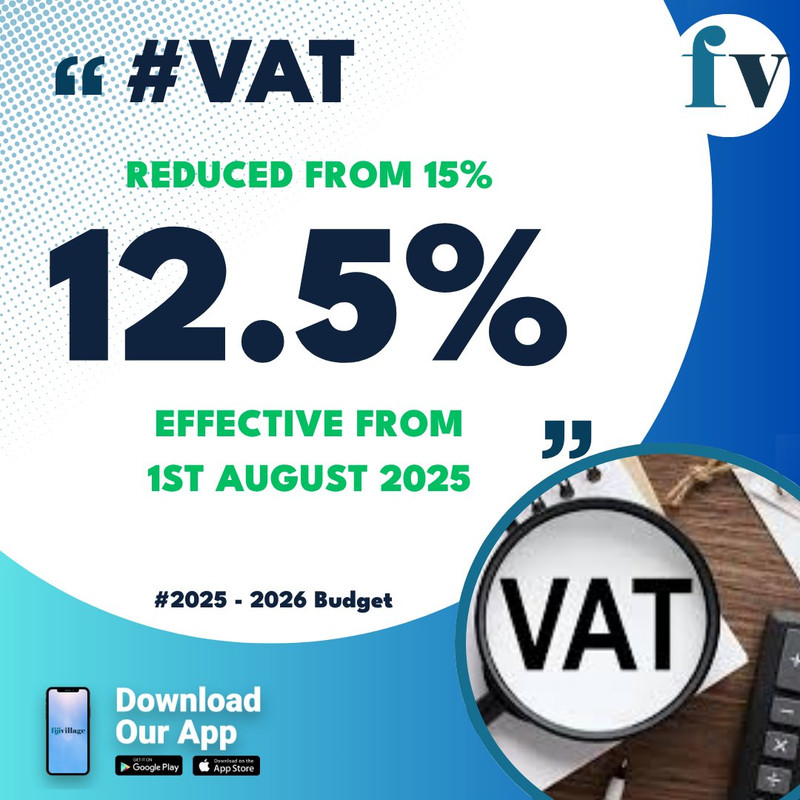

VAT to go down to 12.5%, civil servants pay to increase by 3%, duty protections to be removed.

| 2025-2026 National Budget |

Good news for people as Deputy Prime Minister and Minister and Finance, Professor Biman Prasad has announced a number of measures in the 2025/2026 National Budget to address cost of living which include VAT to be reduced from 15% to 12.5%, civil servants pay to be increased, duty protections to be removed and more assistance to people on welfare programs.

The reduction in VAT from 1st August 2025 will deliver tax relief of $250 million to people.

This is in addition to the $250 million in relief through the zero-rated VAT on the 22 essential items.

Professor Prasad says this is a total of $500 million in VAT relief.

With heavy tariff protections, Professor Prasad says inefficiencies creep in and there is lack of incentives to bring down prices.

Tariff on chicken portions and offals (giblets, liver) which used to receive 42% protection will be reduced to 15%.

Fiscal duty on frozen fish, including salmon is reduced from 15 to 0%, similar to canned fish, like salmon and sardines.

Imported fruits and vegetables - tomatoes, cabbage, lettuce, cucumber, eggplant, pumpkin, banana, avocadoes, mandarins, watermelons and pawpaw will continue to attract 5% duty.

Apples, carrots, grapes, oranges, pears, celery, capsicums, mushrooms, kiwifruits, cauliflower, broccoli, nuts, etc not available in Fiji will continue to attract zero duty.

Potatoes, garlic, onion, tea, cooking oil will continue to attract zero duty.

Duty on lamb products which was reduced to zero percent will continue.

The reduced 15% duty for beef, ducks, corned mutton, corned beef and canned mackerel will continue.

The 5% duty will be maintained on dairy products like liquid milk, powdered milk, yogurt, cheese and butter.

These products used to receive 32% protection under the previous Government which provided a 10-year exclusive tariff arrangement to one private company.

Now anyone can import these dairy products at 5%.

Professor Prasad says they need the business community to support Government and pass these reductions to the people.

He says this support is meant for the consumers, and it is unjust and unethical for businesses to pocket these reductions.

FCCC, Consumer Council, FRCS and the Ministry of Finance will monitor prices closely on the ground.

This taskforce, where necessary, will propose immediate policy response measures like imposition of price controls on new items.

They will look at reductions or even removal of tariff protections provided to our local manufacturers and producers who are unreasonable with pricing.

There will also be fines to ensure compliance with the law.

The Government is also actively working with BAF to open import pathways for key food products.

Fiji is presently able to import whole frozen chicken only from New Zealand, even though there are countries producing competitive and safe poultry products.

Ghee, a staple item in many Fijian households, cannot currently be imported from India.

The restrictions have contributed to higher food prices and reduced consumer choice.

The goal is to introduce more competition into our supply chains, and reduce reliance on a few suppliers.

All social welfare recipients and Government pensioners will receive a 5% increase in their monthly allowances.

This is in addition to the across-the-board 15% increase they were provided in the last budget.

A total funding of $220 million is provided, an increase of $10 million.

Aftercare Fund members will receive a $0.8 million increase in their medical allowance only.

All civil servants will receive a 3% pay rise from August 2025.

This is in addition to the 7 to 20% increase provided in the last budget.

This is a direct cash injection of $115 million into household incomes, $85 million from last year’s increase and $30 million in this budget.

This means that civil servants would have received a total salary increase of between 10 to 23% pay rise within a year.

A 10% bus fare subsidy will be provided for all Fiji citizens for a 12-month period starting from August 2025 to July 2026 at a cost of around $10 million.

This means that every individual travelling by bus will now pay 10% less in fares.

The bus companies will still receive the current regulated fares as Government will pick up the 10% cost.

Students will continue to travel to school for free with blue cards.

The 50% subsidy will continue for all other students with an increased budget of $50 million.

The $200 Back-to-School Assistance will continue and will be paid in January 2026.

$40 million has been allocated to this.

With this, over $170 million would be provided through the back to school policy.

New initiative to support farmers and leaseholders earning less than $50,000 a year to receive a lease premium subsidy of 30% or up to a maximum of $7,500, for lease renewals.

To support landowners, the Committee on Better Utilisation of Land (CBUL) initiative is restored.

This will provide an additional 4% lease rental payment to the landowners taking it to a total of 10% of the Unimproved Capital Value.

Support will also be provided to the TLTB with funding to develop access roads to TLTB leases making it more accessible and productive.

Around $9 million is provided for this.

$4 million will be provided to support the reinstated FNPF pension payment for those pensioners affected by the 2012 pension reforms.

$25 million is provided for free water, free medicines and 50% electricity subsidy.

The cost-of-living package by the Coalition Government in this budget amounts to over $800 million in direct support.

Deputy Prime Minister and Minister for Finance Professor Prasad says to further support affordability, the government has reduced customs duties on several food items, many of which attract low duties of zero to 5 percent.

He says this reduction in indirect taxes must be passed on to the people, and he reiterates that they will be strengthening compliance and enforcement measures to ensure that people benefit directly from these reforms.

Professor Prasad says the classification of personal imports has been amended to clearly distinguish between online purchases and those received as gifts and donations.

He adds under this revised policy, all items received through gifts and donations below $500 will be duty-free and VAT-free.

The Deputy Prime Minister says the government remains firmly committed to tax stability, fiscal responsibility, and putting more money back into the pockets of ordinary Fijians.

He says there are no increases in taxes in this Budget, and they have focused their efforts on targeted relief, incentivising investment, and promoting economic activity in key sectors that support inclusive and sustainable growth.

Professor Prasad says the most significant change in this Budget is the reduction of the VAT rate from 15 percent to 12.5 percent, a bold but deliberate move to ease the cost of living for every Fijian household.

He says this is complemented by the continuation of zero-rated VAT on 22 essential items including medicines, ensuring that low-income families are protected from inflationary pressures.

Professor Prasad says in line with our broader economic transformation agenda, they are also introducing and extending targeted tax incentives to incentivise growth, innovation, and social impact.

He says a 150 percent tax deduction will now apply for donations to Accredited Start-Up Support Programs, fostering entrepreneurship and innovation.

The Minister says under the Employment Taxation Scheme, the 300 percent tax deduction for wages or salaries paid for work placements, apprenticeships, and part-time employment is extended until 31st December, 2026.

He adds the 400 percent tax deduction for hiring persons with disabilities will also be extended until the same period, and these incentives support both workforce participation and social inclusion.

Professor Prasad says for climate transition, they are expanding tax relief for green investments and the income derived from new renewable energy and co-generation projects will now be tax-exempt for 10 years, up from the current 5 years—providing stronger incentives for clean energy adoption.

He adds the Tax-Free Region (TFR) incentive is also being extended to cover the Wainadoi region for waste management, recycling, and renewable energy businesses—sectors that are central to our circular economy strategy.

The Finance Minister says they are also incentivising donations, and a 100 percent tax deduction will now apply to donations made to health centres, nursing stations, aged care homes, orphanages, and drug rehabilitation facilities—supporting vital community institutions that care for our most vulnerable.

Professor Prasad says in the tourism sector, a new 25 percent investment allowance will be introduced for businesses undertaking capital investments in tour and sightseeing operations, with a minimum qualifying threshold of $100,000.

He says this will help diversify tourism offerings and deepen the value chain for our visitor economy.

Professor Prasad says to improve tax administration, they are introducing the VAT Monitoring System (VMS) for all businesses with an annual turnover of $50,000 or more.

He says this will be implemented in phases and will come into effect on 1st January 2026.

Professor Prasad says this system will modernise VAT compliance and improve revenue transparency while reducing tax evasion.

He adds two new VAT refund initiatives will also support our social and environmental objectives.

He says VAT refunds will be available for capital investments in residential solar projects, helping households transition to clean energy.

He further says households that rebuild or repair homes damaged by termites will now be eligible for VAT refunds on construction costs—providing critical relief for affected families.

The Deputy Prime Minister says to support our agriculture sector and improve farming efficiency, mechanical harvester services supplied by registered cooperatives will now be zero-rated for VAT, reducing the cost burden on smallholder farmers and enabling faster land preparation and harvesting.

He adds to support our Fijian diaspora, they will make changes to the Income Tax Act to allow our citizens residing overseas to reorganise and protect their Fiji-based assets through the use of properly structured resident Family Trusts.

He further adds this initiative recognises the deep-rooted connection many diaspora families maintain with Fiji and aims to support intergenerational wealth preservation while ensuring such assets remain invested within our economy.

Professor Prasad says a framework will be developed and rolled out in the coming months to accompany the legislative amendments and support the transparent and responsible use of this concession.

The Minister says they will also reduce the acquisition of Fiji Citizenship and passport fees from the current $3,450 to $1,500 for our diaspora who wish to acquire their Fijian citizenship and return to Fiji to live and invest effective from the 1st of August.

He says this is a pro-people, pro-growth, and pro-investment tax framework, and it rewards innovation, supports job creation, lowers the cost of living, and strengthens the social contract between the state and its citizens.

A series of measures aimed at strengthening policing and law enforcement, curbing drug use, HIV and crime have been announced in the 2025/2026 National Budget as Deputy Prime Minister, Professor Biman Prasad says the Government has agreed to increase the size of the Police Force by an additional 1,000 personnel.

This takes the full strength of the Police Force to more than 6,550 across all ranks.

This is 1 officer to 137 people - meaning 730 officers per 100,000 population. The standard acceptable number is around 300 per 100,000 population.

The Fiji Police Force is provided $240.3 million in this budget, an increase of $13.5 million.

This is a major investment and will be done in two phases at an additional cost of around $40 million.

In the first phase, $19.5 million is provided in the budget to commence the recruitment of 538 additional officers, on top of around 300 vacant positions that will be filled.

This would mean an extra manpower of over 800 officers immediately.

This added strength should now provide a much bigger police visibility, mobility and presence around the country.

The government earlier this month had also approved additional funding of $8.6 million to the Fiji Police Force for their salary progression which will continue.

The new Ministry of Policing is provided a budget of $3.8 million.

The Narcotics Bureau under the Ministry of Policing will lead Fiji’s fight against drug trafficking and substance abuse.

Border protection is being enhanced.

The construction of a new Container Examination Facility is underway and will enhance the ability to detect concealed contraband.

K9 detection capability will be extended to Savusavu under the Duavata Agreement with New Zealand and extending critical assets to our maritime borders.

FRCS has established a dedicated Passenger Information and Intelligence Unit.

This will improve the ability to target high-risk passengers and vessels.

With the drug trade comes dirty money, and the government is strengthening measures to identify and tackle this.

Currently, individuals can open mobile wallet accounts without a Tax Identification Number, and SIM cards can even be purchased with only a photo ID.

These loopholes enable tax evasion, money laundering, and underground economic activity through digital wallets.

To address this, all mobile wallet account holders will be required to register with a TIN and a six-month transition period will be provided to allow for full compliance.

Government will also introduce a mandatory Asset Declaration regime for all registered sole traders in Fiji.

Beginning with the 2025 tax year, all sole traders will be required to submit an annual declaration of their assets and liabilities, alongside their income tax returns.

This will include movable and immovable assets, loans, and sources of income.

This measure will help build a culture of financial transparency, reduce tax evasion, and enhance the integrity of our economy.

Professor Prasad says the HIV epidemic is now a serious growing threat to Fiji.

He says there are now approximately 7,000 HIV cases in the country, and we cannot afford to ignore this rising trend.

Drug use and needle sharing is responsible for 50% of the increase in cases.

This new threat is rising rapidly, induced by sharing of needles and drug related blood transfusion or what is known as blue-toothing.

To fight this, Government is allocating $10 million for a comprehensive approach to testing, prevention, public awareness, and controlling the spread of HIV.

Professor Prasad says these actions represent a clear and coordinated response to crime, drugs, and public health threats.

From the 2025/2026 National Budget onwards, the government will make the use of the free education grant fully flexible.

While making the announcement, Deputy Prime Minister, Professor Biman Prasad says this means school managements will now have full autonomy over how the free education grant is spent.

The current rules such as limiting only 20% for building and compound maintenance, 15% for IT equipment, or 30% for administrative and office expenses, will be removed.

Schools may choose to use 90% for school expansion or allocate none for maintenance if there is no immediate need.

School managements will have the full freedom to plan their spending, save funds, or even borrow against the grant for major investments.

$65 million has been allocated for the free education grant for more than 225,000 students.

The current restriction that limits school fundraising to once per year has also been removed.

Fundraising will now be open and flexible, but voluntary.

Professor Prasad says they believe restoring this partnership will promote a deeper sense of ownership and engagement in the education of our children.

The School Management Association will be provided with a first-time funding grant of $500,000.

This will support capacity development and leadership training for school managers.

$300,000 each will be provided to the Principals Association and the Head Teachers Association for the first time.

Teachers’ salaries are increasing further across the civil service by an additional 3% in this budget.

The government plans to recruit 1,125 new teachers.

This includes 962 secondary school teachers, 117 primary school teachers, 41 early childhood education teachers and 5 special education teachers.

They are recognising the critical role of Early Childhood Education by funding ECE teachers on a full-time basis.

The government will now regularise their appointments.

This places them on equal footing with other teaching staff.

$416 million is allocated for teacher salaries in the upcoming financial year.

The school curriculum is under review. Vernacular language study will be made compulsory up to a certain educational level.

Through the Government's transportation assistance scheme, they continue to support students in travelling to and from school, either by bus, rural service operators, or boat transport.

For students with yellow cards (parental income above $16,000), Government will provide a 50% subsidy.

This means that no child or parent will bear any additional cost, even though student fares had doubled.

Top-ups will now be available only to students with active FEMIS IDs.

Once a student leaves school, their subsidy will automatically cease.

Government is allocating $153 million to fund tertiary studies for 24,653 students, which includes 11,593 continuing students and 13,060 new students.

This will be a historically high number of students under full scholarships.

The new increased rates for scholarship allowance are as follows:

For Merit Based High Achievers Local Scholarship, the scholarship allowance will be increased from $6,800 to $7,600 per year.

For other Merit Based Schemes where students are from outside the campus city, the allowance will be increased from $5,000 to $5,600 per year. For other Merit Based Schemes where students have their home in the campus city, the allowance will be increased from $3,000 to $3,200 per year.

For Students with Special Needs Scheme, the allowance rate has been increased from $6,800 per to $8,600 per year.

This is to accommodate travel costs and purchase of special gadgets for study purposes.

The government is also introducing Equity and Inclusion Based Allowance which is to accommodate students from low socio-economic background particularly for students whose both parents are deceased and are either taken care by legal guardian or staying in home care.

These students will receive an additional allowance of $1,000 per year.

This is applicable to students on Home and Away Campus Allowance and students will be required to provide necessary documents.

Government had introduced a minimum cut off mark of 250 out of 400 in year 13 for all degree programmes.

To bring some equity in the scholarship scheme, the cut-off mark for students from rural and maritime zones will be reduced to 240.

The number of TVET scholarships is being increased from 2,780 to 4,500.

TVET scholarships will be extended to students with special needs, similar to the existing provisions for higher education.

Apart from construction, tourism and hospitality and automotive, 5 categories will be added.

These include Traditional Handicraft making with 300 scholarship grants for training on basics of Wood Carving, Tapa or Masi and Weaving.

Performing Arts with 200 scholarship grants for improving Dance and Song for the entertainment industry.

Community Tailoring with 300 scholarship grants for training on Basics of Sewing.

Women Small Business Operations with 100 scholarship grants for training on basics of Bookkeeping and Marketing.

Vocational Literacy and Numeracy with 1000 scholarship grants for 3 months of training for early school leavers intending to pursue vocational certificate III and IV.

For overseas scholarships, apart from degree and post graduate programmes, the government is now expanding it to allow students who wish to undertake TVET qualifications in Australia and New Zealand.

$3,000 per student will be allocated for visa lodgment and processing.

TSLS will engage a licensed agent to get visas processed on time and send students before commencement of classes.

Meal allowance has been increased from $150 per week to $250 per week, commencing from Semester 2 of 2025.

Stipends will be paid directly to students account, and they can decide on renting out or staying in hostel.

A new initiative of Contribution Scheme will be introduced.

Under this new scheme, students will be allowed to apply for partial tuition assistance on a cost sharing basis where TSLS will pay 50% of the tuition fees while students will take care of the remaining 50% of the tuition fees.

This scheme will provide incentivized bond service whereby their bond service will be 1:1, lower than the current 1.5 times for tuition only students and 2 times for students on both tuition and allowances.

$847 million is allocated to the education sector.

The Ministry of Education is allocated $675 million.

This includes $86.5 million for higher education institutions.

$153 million is provided for tertiary scholarships.

Over 84 schools across Fiji have been renovated, repaired, and upgraded.

Many of these schools had suffered damage from past cyclones or had long been in a state of disrepair.

The government is currently focused on determining the most appropriate location for Fiji’s new national hospital.

While delivering the 2025/2026 National Budget, Deputy Prime Minister, Professor Biman Prasad says they are committed to moving the hospital out of the CBD and to a more accessible location for the people of the greater Suva-Nausori area.

Seven sites are currently under investigation, including Davuilevu, Tamavua, Raiwaqa, Samabula, Valelevu, Nabua and the existing CWM site.

Apart from site selection, they have also been working together with financiers led by the World Bank for a first phase financing package tentatively estimated at around $500 million.

The project and financing package is currently being worked on and an announcement will be made later this year.

He says they will need to increase the bed capacity from the current 453 beds at Fiji’s largest CWM hospital to 703 beds.

Professor Prasad says they need to cater for new services based on our disease profile and projections.

He says we need to make provisions to cater for the needs of the broader Pacific region too as this will also serve as a regional hospital.

The whole project will be costly and very expensive to the tune of almost $2 billion.

Professor Prasad says they are committed to getting this done with the support of our development partners and multilateral financiers like the World Bank and Asian Development Bank.

Detailed engineering assessment of the existing CWM Hospital has been completed, and 27 key priority projects have been identified which will cost around $63 million, with an initial funding support of $15 million from the Government of Australia.

This is in addition to the $8 million government financing component under the Ministry of Health.

The first phase of upgrades is underway, including renovation to the acute patient ward, increased backup water storage, replacement to sewer lines and repairs to roofing.

Additional projects will commence over the remainder of 2025.

They are also advancing the construction of a 100-bed Super Specialty Hospital in Nasinu, supported through a grant by the Government of India.

Land acquisition is now complete, and an Memorandum of Agreement is to be signed soon on the construction, operation and maintenance of the hospital.

The construction of this new hospital is expected to commence soon as design and procurement is finalized.

Professor Prasad says they have been encouraging and providing the necessary support through tax incentives and other support to entice the private sector to invest in hospitals.

The outcome has been positive.

He says we now have a number of private sector players - Pacific Specialist Healthcare, Oceania Hospitals, MIOT Pacific Hospital, Sai Prema Hospital, Heart International and the PPP hospital in Lautoka and Ba managed by Health Care Fiji.

$117 million has been allocated for the ongoing operations and maintenance costs to Health Care Fiji for the Lautoka and Ba Hospitals under the Public-Private Partnership arrangement.

With the help of IFC, they are currently reviewing the agreement to ensure it is cost effective and delivers the best services to our people.

Health Care Fiji is also expected to start the construction of a new 200 bed hospital in Lautoka.

An increased budget of $466 million has been provided to the Ministry of Health to fund the salaries of our doctors, nurses and allied health workers, procurement of medicines and biomedical equipment, upgrade and maintenance of hospitals and health centres across the country.

Continuous reforms are being undertaken at Fiji Pharmaceutical and Biomedical Services to ensure timely availability of medicines.

New tenders have been awarded for supply of major drugs and medicines.

An online logistics management system (MSupply) has been adopted to track medicine stock and manage orders across hospitals.

The government has also signed an agreement with the Indian Pharmacopoeia Commission to allow them to buy medicinal drugs from India, in the most cost-effective way while ensuring that standards are always maintained.

They are continuing with the public private partnership, under the free medical scheme with over 64 general and dental practitioners and medical lab providers, that provide free medical services to our people.

They are also supporting kidney dialysis with an increased subsidy of $4.7 million to cater for the increased demand at private service providers.

The government will also continue to provide $4 million in operating grant to the Sai Prema Hospital, a great public private partnership programme focused on delivering heart-related services to our children.

To enhance service delivery and strengthen the dignity of care provided to families during times of loss, the government is allocating $1.2 million for construction of new mortuary units at health facilities across the country.

These include the Rakiraki and Tavua Sub-Divisional Hospitals, Nadarivatu Health Centre, Kadavu, Levuka, Savusavu, Dreketi, Seaqaqa, Wainibokasi, Nayavu Health Centre, Navua, Nabouwalu, and Taveuni Sub-Divisional Hospitals.

A record allocation of over $600 million is provided to our health sector in this budget, and in addition they are mobilizing almost a billion dollars in investments to start the new national hospital and other priority health infrastructure across the country.

The government will undertake a major lay of 11.7 kilometres of water pipeline from Sawani to Colo-i-Suva and to Khalsa Road junction, a new pump station and the construction of two 5-megalitre reservoirs.

Deputy Prime Minister, Professor Biman Prasad says this project will ensure that the elevated areas such as Sakoca, Nagatugatu, Tacirua, Dokanaisuva and Coloisuva that faces continuous intermittent water supply will be able to receive 24/7 reliable water supply.

This project will also allow operational flexibility and be able to improve water supply along Princes Road.

They are also investing in the construction of a new 20-megalitre Water Treatment Plant to complement the existing Tamavua Water Treatment Plant with a total cost of $12 million.

This initiative will benefit 230,000 people living along the Suva to Lami corridor and parts of Nasinu.

It will enhance treatment capacity, allow for faster implementation timelines, and support future expansion to meet increasing water demand within these densely populated areas.

The Water Authority of Fiji has also begun works for the development of a new water treatment plant in Navua as well as a new water supply scheme in the Wainadoi area that will have a coverage area from Naboro to Nabukavesi, with the potential to extend towards Togalevu and Naimelimeli in Navua.

WAF is looking into extending water supply services from Veinuqa to Kasavu in Tailevu as well as from Naqali to Lomaivuna in Naitasiri.

In the Western Division, they are upgrading the water mains which will benefit around 80,000 people living within and along Dreketi Feeder Road, Vuda, Wairabetia, Nadi Airport, Nadi Back Road and Sabeto Road areas, focusing on improved and consistent water supply.

They are also investing in water extensions to previously unserved communities such as those in the Korovuto area in Nadi, and the Coral Coast region in the Votua area in Sigatoka.

Water source improvement works has been allocated as well to improve water supply services with the proposed works for Qalau and Nasivi intakes in Ra and Tavua respectively and rehabilitation works for Nadrou and Varaciva pump stations in Ba.

In the North, they are upgrading the Benau Water Treatment Plant, as well as water mains upgrade to Rara and Volanau in Labasa and this includes improvement works for Naidriva in Savusavu as well.

In addition, WAF has begun works for the proposed Wainivasa Water Source in Taveuni.

The government will soon start the legislative changes required for the corporatization of the Water Authority of Fiji.

WAF has been provided increased funding of $284 million to fix the infrastructure, including upgrading of water sources and treatment plants, reticulation and distribution and non-revenue water reduction.

Half of all the water that is collected, treated and then distributed through the WAF pipe network never reaches the tap. This has been a long-standing issue, neglected for decades.

In the upcoming financial year, the government is committed to a strategic path aimed at reducing non-revenue water significantly, from nearly 50 percent down to 20 percent over the next 5 years.

Then they will attack the last 20 percent.

Great news for Fiji National Provident Fund members as FNPF has announced a landmark achievement with a remarkable interest rate of 8.75% for the financial year ending June 30th 2025.

This marks the highest credit interest rate in over 30 years, with a total of $698.75 million to be credited to members' accounts.

FNPF says this significant milestone highlights the Fund's strong investment performance and unwavering commitment to securing the future of its members.

Chief Executive Officer Viliame Vodonaivalu says for the financial year ending 2025, the Fund achieved a total investment income exceeding $1 billion, a testament to FNPF’s robust, diversified investment strategy and its ongoing focus on sustainable, long-term value creation.

He says their investment strategy is deeply anchored in delivering long-term benefits to the members while ensuring the Fund’s financial integrity,

The Fund's investment income was largely driven by equities, which accounted for 52% of total earnings.

Government bonds contributed 27%, while commercial debt investments provided 11%, and property and other portfolios made up 10%.

On the global front, the Fund invested in an S&P 500 Index tracking Exchange Traded Fund and enhanced its holdings in BSP Financial Group Limited.

It also diversified its portfolio of Australian-listed equities to include listed real income securities in developed global markets, all of which contributed positively to the Fund’s performance.

Significant local investments during the financial year included purchase of prime land in Pacific Harbour, investment in Naisoso Radisson Blu Mirage through the purchase of an ABA, syndicated loan facility, and securing mezzanine debt, a capital injection into Farleigh Limited, dividend reinvestment in HFC Bank shares and providing a loan facility to Fiji Airways.

Members are encouraged to check their updated balances starting Tuesday, July 1st via the MyFNPF App.

Deputy Prime Minister and Minister for Finance, Professor Biman Prasad has announced an expansionary 2025/2026 National Budget with a total revenue of $3.9 billion and total expenditure of $4.8 billion. This is a net deficit of $886 million.

Based on this, government debt is projected at $11.7 billion - around 79.8% of GDP.

Professor Prasad says this is about 10% lower than what the coalition government inherited in 2023.

He says the expansionary fiscal stance is deliberate to protect our people.

Great news to low-and middle-income earners as the Government through the Housing Authority and Public Rental Board, is looking at delivering around 2,900 residential lots and more than 1,800 houses in Nepani, Wanibuku, Davuilevu, Tavakubu, Tavua, Wairabetia, Tacirua, Waqadra, Waila and Veikoba.

Deputy Prime Minister and Minister for Finance Professor Biman Prasad says access to housing remains a challenge, especially in our major urban centres.

He says apart from the Housing Authority and PRB, they are also collaborating with other key partners like Habitat for Humanity, HART, Koroipita and other private sector partners to deliver affordable housing solutions.

Professor Prasad says a total of around $4 million is provided for these partnerships.

He says the tax incentive available for the development of subdivisions has been extended which provides developer profit exemptions and customs duty concessions for land developers undertaking investment in residential subdivisions.

The Deputy Prime Minister adds this has been quite effective in encouraging investors to add additional residential lots and increasing the overall stock of housing in Fiji.

He also highlighted that the low-interest rate environment remains conducive for housing finance with home loans provided at just below 4 percent from the commercial banks.

Professor Prasad says they will also allow FDB to re-introduce housing loans on a small scale. The Deputy Prime Minister says to support low and middle-income families with home deposits, they will continue with the first home buyers grant.

He says for those earning below $50,000, a government grant of $30,000 is available for first home construction while $15,000 is provided for first home purchase.

Professor Prasad says for those earning above $50,000 but less than $100,000, a first home construction grant of $20,000 is available and a $5,000 grant for first home purchase.

He adds this will continue with a budget of $3.5 million.

On informal settlements, Professor Prasad says the country faces major challenges in this area and the rise in squatter settlements is linked to our history.

The Minister says they remain committed to redeveloping and formalizing our squatter settlements with the issuance of proper lease titles and appropriate facilities and services.

He says around $15 million is provided for the formalization of 6 informal settlements in Tavela, Tore, Field 40, Valequyaya, Sakoca and Vunika.

Professor Prasad says they will also start four new areas including Lovu Seaside, Nabare, Delaisaweni and Caubati where this will formalize around 1500 housing leases.

In response to eviction notices given to families in areas like Nabua Muslim League, Veidogo in Vatuwaqa, and Nadiri, the Deputy Prime Minister says the Government is providing funding of $2.2 million for relocation and resettlement.

He says the funding will be used to commence critical preparatory work, including consultations with affected communities, land negotiations, and detailed implementation planning to ensure that affected families are provided with secure resettlement options.

Professor Prasad says the VAT refund scheme for the construction of homes will continue and under this scheme, any person constructing their first home is eligible for a refund of all VAT paid on construction material up to a value of $120,000.

He adds that they are also expanding this for the installation of solar power on residential homes and reconstruction of homes destroyed by termites for households with less than $50,000 income.

The Minister says this will complement the termite construction subsidy of $5,000 provided to families earning less than $30,000 and $2,000 to those earning between $30,000 to $50,000.

He says the Government has allocated $2.9 million towards this, on top of the $5 million that has already been spent when the initiative was introduced.

The Fijian Elections Office is allocated $20 million in the 2025/2026 National Budget.

Deputy Prime Minister and Minister of Finance Professor Biman Prasad says this provision allows for preparatory work for the next general elections, demonstrating their commitment to democratic processes and electoral readiness.

Four critical bridges valued at $400 million have to be replaced and this will be done by concessional loan and grant financing through the Asian Development Bank and the World Bank.

Dpeuty Prime Minister, Professor Biman Prasad says this includes the replacement of the Lami Bridge at Suvavou, Medraukutu Bridge near the Lami Cement Factory, Sabeto Bridge, and Viseisei Bridge linking Nadi and Lautoka.

The Fiji Roads Authority is provided a funding of $388 million, an increase of $37 million from the previous year.

This includes almost $120 million for road maintenance.

$74 million is allocated for road renewals, replacement and resealing, $23 million for footpaths and bus shelters and $30 million for new sealing and upgrading of community and rural roads, including around $5 million for the tar sealing of Kavanagasau road (Laselase to Naroro) and also for Biausevu Road in Sigatoka and Vuci, Naduru and Koronivia roads in Nausori.

$16 million is provided for the maintenance of our jetties in Koro, Moala, Lomaloma, Vunisea, Nabouwalu, Savusavu, Taveuni and Rabi.

The government is working with the Asian Development Bank on 3 major investment projects to revamp the jetties in Nabouwalu, Natovi and Savusavu.

There are also major plans being worked out to ease traffic in the major urban centres, including from Lami to Suva and Suva to Nausori, Nadi to Lautoka and in Labasa town area.

FRA is working on options for road widening, provision of footpath and bicycle lanes, improved lighting and introducing smart traffic signal systems.

They are also providing $500,000 for feasibility study on a flyover road from Suva to Nausori.

The government is also commencing the Labasa Bypass Project.

This long-awaited infrastructure development will ease mobility in the Northern Division.

By diverting traffic around the town, particularly during peak periods such as the cane crushing season, they will reduce congestion, improve safety, and enhance the efficiency of commercial and personal transport.

They are investing in approximately 82 kilometres of upgraded rural roads, with a focus on strategic corridors such as the Nabouwalu, Wailevu West Coast, and Natewa West Roads funded by government of China.

The government is also working with the Asian Infrastructure Investment Bank to undertake a major investment to fix our rural road infrastructure.

To curb the shortage of passports at the Ministry of Immigration, the Government has allocated around $6 million to cater for the procurement of 200,000 passport books.

Minister for Finance Professor Biman Prasad says the budget responds decisively to an issue that has affected thousands of Fijians both at home and abroad.

He says the Ministry of Immigration is provided a budget of $17.8 million.

Professor Prasad says this volume is expected to fully meet both the backlog and forecasted demand over the coming months and they anticipate that, with this intervention, the passport shortage will be normalized, and service delivery will be restored to expected standards.

He says they will also reduce the acquisition of Fiji Citizenship and passport fees from the current $3,450 to $1,500 for our diaspora who wish to acquire their Fijian citizenship and return to Fiji to live and invest effective from 1st of August.

The reduction of VAT from 15 to 12.5 percent that was revealed in the 2025/2026 National budget announcement today was a difficult decision that the coalition government had to make but it was done for the people to reduce the cost of living.

This was highlighted by Prime Minister Sitiveni Rabuka following the National Budget announcement today which he describes as an expansionary budget.

Rabuka says the reduction of VAT means a loss of revenue, as the 1 percent is $100 million, so they have to look at that very seriously.

He adds that the final analysis that they made was that they could afford it, and it would be a great benefit for the people.

When asked about the National Budget outlining significant investments in infrastructure and innovation, and how he foresees these investments driving economic growth for the short term and long term, Rabuka says there will be more investments and employment.

Rabuka says this budget will have a great impact on people's lives as well as the condition of national infrastructure, improving mobility, connectivity, and the social lives of people.

Leader of Opposition Inia Seruitatu has labeled the 2025-2026 National Budget as satisfactory but stresses the importance of maintaining a balance between expenditure and income, given the high debt level and deficit.

While responding to questions by fijivillage News, Seruiratu says they appreciate the assistance but let's be considerate because in the end, we are all taxpayers, and we are the ones that will foot the bill itself.

He says they appreciate the 5 percent increase in social welfare allowance across the board but we cannot have all that we want and the responsibility lies squarely with the recipients as well.

@fijivillage.com Seruiratu labels budget as satisfactory but warns about rising debt

♬ original sound - fijivillage

Seruiratu further says the decision by the government to allow school management full autonomy of the Free Education Grant is bold and he hopes the monitoring system will be effective.

He says they have had experiences in the past where funds were not used to the very purpose it was meant for or abused.

The Leader of Opposition has also welcomed the huge investments that are in the pipeline for the health sector but says that in the meantime, there is a lot of maintenance work carried out by government however, the new facilities will have impact.

The 2025-2026 National Budget debate will start on the 14th of July.

The Fiji Council of Social Services has welcomed the reduction in VAT to 12.5 percent, increase in social welfare assistance and funding for Ministry of Rural Development as it responds to some of the concerns for the citizens.

While speaking to fijivillage News following the 2025-2026 National Budget Announcement, FCOSS Executive Director Vani Catanasiga says in terms of the reduction of bus fare by 10 percent, the government is beginning to realise the experiences of ordinary citizens.

She says they still have to address the issue of the bus cards, which a lot of citizens have complained about.

Catanasiga says the government debt of more than $880 million in the next financial year in not a concern for FCOSS as the GDP to debt ratio has been decreasing slowly.

She says the government has demonstrated since they have come in that they have a strategy but they must stick to it and exercise some discipline in terms of expenditure.

She says they note the increase to the Ministry of Rural Development, particularly in terms of addressing critical infrastructure, roads, bridges, footpaths and light as this is something they had made submissions on and they are looking forward to how that is going to be implemented.

FCOSS welcomes VAT cut, welfare boost, rural funding, and backs government debt plan

— fijivillage (@fijivillage) June 27, 2025

Read more : https://t.co/GG22KrUOFV pic.twitter.com/HcNQPBG50S

She says they also welcome the changes that have been taking place in the public finance management system as the government has removed ‘R’ in the budget or need for requisition process by which ministries can access funds.

Catanasiga says she hopes this translates to some traction on the ground in terms of capacity to implement, because that has been used as an excuse by various government departments for why works are delayed.

The 2025-2026 National Budget debate will start on the 14th of July.

Following the approval for schools to host fundraising activities after the announcement of the 2025–2026 National Budget as a way to generate additional income, Catholic Education Representative Ben Salacakau says he is not satisfied with the grant given to the upgrading of the school facilities, adding that the funds provided for the Back to School Support should instead be used to improve schools in a poor condition.

Salacakau says schools were built in a partnership that share responsibilities between schools and parents.

He says many schools need repairs, but due to a lack of grants, these needs have been delayed.

He says the ability to raise funds now brings hope for improving school facilities.

Salacakau adds that although the term ‘voluntary’ was emphasised during the budget announcement by Deputy Prime Minister and Minister for Finance, Professor Biman Prasad, they will continue to encourage parents to support this initiative.

He says parents are ultimately responsible for their children’s education, and for that reason, they will be willing to support efforts to raise funds.

We have taken a very deliberate stance in raising our expenditure which means a slightly bigger deficit, that also means that our nominal debt is $11.7 billion but the most important measure of the sustainability of debt is the debt to GDP ratio.

Deputy Prime Minister and Minister for Finance, Professor Biman Prasad highlighted this at the Post Budget press conference saying when they came into government, the debt to GDP ratio was over 90 percent and in two years they have brought it down to around 75 to 76 percent.

He says they are increasing the deficit from 3.5 percent to 6 percent which is about a 2.5 percent increase.

Debt to GDP is still lower than what it was when we came in – DPM Prasad

— fijivillage (@fijivillage) June 27, 2025

Read more : https://t.co/nXgTRAobhb pic.twitter.com/eLEQTz2BhB

The Deputy Prime Minister says this will take the debt to GDP ratio above what they had in the last budget to 79.8 percent which is still lower than 80 percent and 10 percent lower than what it was two years ago.

He says they can further help our people address issues such as deficit in infrastructure, health, education, HIV, new problems that we are now confronting as a result of lack of attention of those in the past.

Professor Prasad says they are very pleased with the two budgets that they did in the past because they were able to raise more revenue, that has put them in a very strong position for this budget.

The Deputy Prime Minister says they feel very confident about raising the deficit in this budget, as they are confident that the GDP is going to grow further.

He says they are looking at about $5.8 billion worth of investment projects of which a lot are being undertaken, some have been completed and what they are seeing is the interest in Fiji from overseas investors, diaspora, and they are doing a lot more work to get our diaspora to come back.

Prof. Prasad adds they expect to revise the growth forecast downwards from 3.4 to 3.2 percent, and he is very confident barring any very drastic international economic condition, they will be able to achieve higher than 3.4 percent growth.

Minister for Immigration Viliame Naupoto has revealed today that the Fiji passport offices will be open until 8pm as soon as the new batch of passports arrive, so that it allows people to walk into the passport offices after work and get their passports done.

This is after he was asked by fijivillage News if this budget will see the decrease in delays of passport processing which has been a concern raised by the public lately.

Naupoto says the Ministry of Immigration will be working overtime to clear the backlog of applications that are already in, which will be about 6,000, and then from then on they expect the most normal operations for passports.

He says in terms of permits, the Ministry has been working hard, and the staff have been working overtime for the last month, which has seen 31,000 entries cleared up until yesterday.

Naupoto says this means that there should be a faster process for permits, and getting the passport issue dealt with when the new batch arrives.

He says they are looking forward to get another 200,000 passport books which was announced today, that should keep them going for the next year or two.

The Ministry of Immigration is provided a budget of $17.8 million during the 2025/2026 National Budget announcement today.

With the increase of funding for cooperatives now, this means there will be more spending done on it since it is a growing component of the small business economy and it has a lot of potential for the country.

This was highlighted by Deputy Prime Minister and Minister for MSMEs Manoa Kamikamica following the announcement of the 2025/2026 National Budget.

Kamikamica says they did ask for increases in their funding for MSMEs and cooperatives, and they now have dedicated funding for cooperatives that has been increased to approximately half a million dollars.

He says they are excited to be doing more this year.

Kamikamica further says in terms of spending, they are hoping to utilise around 92 percent of their budget.

When asked about what he thinks about the budget, Kamikamica says he is fine with it despite the decrease in allocation for his Ministry.

The Government is strengthening the iTaukei administration to ensure that the benefits of development reach our ordinary iTaukei communities and at the same time, protect their culture, traditions and rights.

While announcing the 2025/2026 National Budget, Deputy Prime Minister and Minister for Finance Professor Biman Prasad says $2.8 million is provided for monthly allowances for the Turaga-ni-Koro, and almost $2 million for Mata-ni-Tikina, Vanua Leadership and District Advisory Councilors.

He says to promote the education of Indigenous Fijians, employment, businesses and overall economic development, the iTaukei Affairs Ministry received an increased budget of $41 million.

The Finance Minister highlighted that this is an increase of $25.5 million since the Coalition Government came into office, including an operating grant of $7.2 million to the provincial councils and $4.7 million to the iTaukei Affairs Board.

He says to support the Justice of the Peace, who provide essential public services in our communities, for the first time, they will be provided a monthly allowance of $100, and $1 million is allocated in this Budget.

He adds that $3 million is provided for iTaukei resource owners' support and development fund, which provides a 3-year interest subsidy on loans through FDB and Merchant Finance.

The Minister says $2 million is also provided to support village improvement with small development works.

He highlighted that the Multi-Ethnic Affairs is provided with a total budget of $6.9 million for the promotion of social cohesion and cultural development, installation of gas-fired crematoriums, rural community cemeteries, associated infrastructure for dignified funeral services, digitization of Girmit records and Girmit Day celebrations.

Considering all the different efforts, the 5 percent increase in social welfare allowance will have to do for now.

This has been highlighted by Minister for Women, Children and Social Protection Sashi Kiran following the announcement of the 2025-2026 National Budget.

Kiran adds they are appreciative that there has been a lot of effort made for reduction in cost of living and increased budget for child protection and gender-based violence.

She says she is happy with the new housing opportunities for youth, incentives for rural infrastructure and medical facilities, and focused funding for HIV, AIDS, and crime prevention.

The Minister also welcomed continued support for termite-infested homes.

The 2025-2026 National Budget debate will start on the 14th of July.

The Government has made a bold move in the 2025/2026 National Budget as they have removed all “R” (requisition) items, which previously required ministerial or permanent secretary approval before spending.

The announcement was made by the Deputy Prime Minister and Minister for Finance Professor Biman Prasad in Parliament, stating that this shift is being piloted to streamline operational processes, reduce bureaucratic delays, and improve efficiency and accountability in budget execution.

Ministries and departments will now be entrusted with greater operational flexibility, underpinned by stronger monitoring and policy oversight from the Ministry of Finance.

Professor Prasad has also allocated $4.1 million for the completion of Phase 2 of the Household Income and Expenditure Survey, where the data collected will provide the Government with a detailed picture of income level, expenditure patterns, and updated poverty estimates that will help guide public policy and Government interventions.

He says $740,000 is for preparatory works for the 2027 Population Census.

Professor Prasad says this census will be crucial in capturing the demographic, economic, and social trends that will shape our national planning over the next decade.

He adds his Ministry is allocated a total budget of $91 million, which includes $54 million to fund the operations of the Fiji Revenue and Customs Service. The Deputy Prime Minister says a total of $4 million was allocated for the milestone payments related to the new FMIS system that went live on 1st August last year.

He says in tandem with this, $1.8 million has been allocated for the implementation of a new Budget System aimed at automating the budget process, which should be completed in the next 12 months.

Professor Prasad says as part of the public financial management (PFM) reform agenda, the Ministry of Finance has undertaken a comprehensive reclassification of budget expenditures in the 2025–2026 Budget. He adds this reform is guided by international best practices and the recommendations of the Public Expenditure and Financial Accountability (PEFA) assessments.

The Nadi Chamber of Commerce and Industry welcomes the announcement of the 2025/2026 National Budget, stating that it is quite a fair and inclusive one.

President Lawrence Kumar says the new budget outlines essential initiatives that have emerged from a comprehensive public dialogue process with various targeted groups.

Kumar says the new budget prioritises tackling socio-economic challenges while also maintaining macroeconomic stability.

He also says he was glad about measures taken to support the average family in areas such as a reduction of VAT from 15 percent to 12.5 percent while maintaining that the government needs to exercise prudent reductions to avoid revenue losses and have a balance on reductions on VAT to ensure government operations are not heavily affected due to lack of revenue collected if VAT is heavily reduced.

The businessman says other sectors, such as the Ministry of Public Works, which is allocated $800 million in the new financial year, with the Fiji Road Authority taking $388 million, and the Water Authority of Fiji $284 million is going to help the economy grow and create employment as well.

He also highlighted that it is encouraging to see that other major sectors such as health have been prioritised with an increase from $451.8 million to $611.6 million, with the continuation of a free medical scheme with $10 million dedicated to these schemes.

He adds this is a substantial increase from last year's budget.

He says the bus fare reduction by 10 percent is going to assist the general public in daily travel while having a social benefits increase of five percent from last year is surely a plus point as well.

Kumar adds housing assistance for first-time homebuyers, with those earning $0 to $50,000 annually getting a $30,000 grant, and the first-time land purchase getting $20,000 for a first-time buyer as well.

He adds such initiatives would surely promote home ownership.

He says the announcement of an 8.75 percent interest payment to FNPF members remains quite positive and will boost confidence amongst members.

The President says it is quite a huge increase because such a substantial payment of 8.75 percent has not been made in many years.

He says this is one of those very key initiatives and key outcomes out of this budget to the FNPF members.

In terms of revenue, Kumar says the projected revenue collection is projected at $3.9 billion, with an expected projected expenditure of $4.8 billion, a deficit of $886 million.

He says the deficit is relatively high, but he understands where the government is coming from with the global crisis upon us and the ever-increasing cost of freight, the government needs to take such bold initiatives to assist the average income earner and assist the citizens of Fiji.

He stressed that huge allocations to respective ministries come with huge responsibilities, so respective ministries and respective ministers need to ensure that the budgets are always managed and implemented with the highest level of accountability.

He says the respective ministries have a huge duty on their hands.

Kumar says at the end of the day, respective ministries and government agencies should ensure that they are able to implement and monitor effectively their budget to ensure that the funds that are allocated are put to good use.

The President adds that there is a need to ensure that services are delivered to the people and there is no mismanagement of finances that are dedicated under respective government agencies.

The increased funding for Tourism Fiji has been warmly welcomed by the Fiji Hotel and Tourism Association saying this will enhance international marketing efforts—an increasingly vital investment amid intensifying global competition.

In a statement, the FHTA says it is vital that efforts to boost productivity, attract investment, and encourage innovation are accelerated to ensure the long-term viability of the budget’s social support and development commitments.

Following the announcement of the 2025/2026 National Budget Announcement which saw the Ministry of Tourism and Civil Aviation being allocated a total budget of $93 million, and Tourism Fiji getting an increased budget of $48 million, the FHTA says they are particularly impressed with the reviewed focus on infrastructure development, education, and health services.

They say this is because FHTA was one of many private sector organisations highlighting the need for more focused budgeting, planning and delivery in these critical areas.

They further say that while the reduction in VAT will undoubtedly be welcomed by many, the resulting significant decline in government revenue must be strategically counterbalanced by coordinated, whole-of-government support to ensure that development initiatives, efforts to diversify the economy, and the creation of new business opportunities proceed with urgency and purpose.

The FHTA says the budget reaffirms the Government’s focus on building a resilient and inclusive economy, however, with a notable reduction in revenue streams, sustaining this vision will require an even stronger emphasis on stimulating economic growth.

They say the budget also introduces targeted measures to ease the cost of living, improve access to affordable housing, and strengthen the delivery of essential services such as roads and water systems.

The Vanua Levu project is a key priority for the Ministry of Tourism over the next 12 months.

While speaking after the announcement of the 2025–2026 National Budget, Minister for Tourism Viliame Gavoka said that currently, only 4 percent of tourism numbers are attributed to Vanua Levu, and the Ministry aims to boost this in the next budget year.

Gavoka also highlighted that one of the current challenges is the imbalance between the number of airline seats and the availability of hotel rooms.

He says the Ministry wants to expand tourism activities, promote more authentic attractions, and create additional experiences across the country.

The Minister also highlighted that they have a Tourism Sustainable Framework, and a major focus of that is to develop tourism outside the current tourism hotspots.

The government is not looking at reviewing the National Minimum Wage rate anytime soon.

While speaking to employers during the Post Budget Breakfast held at the Grand Pacific Hotel, Deputy Prime Minister and Minister for Finance Professor Biman Prasad assured them that the minimum wage is not going to be reviewed anytime soon.

He says the government wants to work with employers to ensure that our workers are looked after well, however, there is an issue about productivity facing the country.

Showing gratitude for what Professor Prasad announced, the Fiji Commerce and Employers Federation says this will definitely and immediately generate more confidence within the private sector and with potential investors.

FCEF Chief Executive Officer Edward Bernard says this announcement allows businesses to plan their next financial year with more certainty and re-look at their investment and human resource plans that were on hold.

Bernard says in April this year, the minimum wage had increased by 25 percent and in the last five years by more than 80 percent.

He says while he can understand that wage rates have stagnated against the increasing cost of living, businesses of all sizes and in all sectors are also faced with the increasing cost of doing business.

Minister for Education, Aseri Radrodro has welcomed the flexibility given to schools in terms of fundraising and the complete autonomy given to the school management of the Free Education Grant to look after school repairs, maintenance or new buildings.

While responding to questions following the announcement of the 2025-2026 National Budget, Radrodro says it will also depend on the government to ensure that they put in proper controls for accountability of those funds.

He says for fundraising, they will have heads of schools to ensure that they do the monitoring on behalf of the Ministry of Education.

Radrodro says the Ministry will have to see how best they can control, and ensure that proper approval, authority, and the collection is being used for the purpose it was fundraised for.

He also says with respect to e-transport cards for students, they have initiated a meeting with Vodafone Fiji and they hope to resolve all teething issues before the end of the term.

The Minister adds the 3 percent civil service pay rise, combined with the earlier 7 percent, is part of a gradual approach to improving teacher remuneration rather than an immediate solution.

He adds he is especially happy for ECE teachers as the Ministry will now be able to pay them for the full 8 hours.

The 2025-2026 National Budget debate will start on the 14th of July.

Click here for Budget 2025-2026 stories, documents and details

Stay tuned for the latest news on our radio stations